Things You Need to Know About Online Loans Pilipinas

The Department of Trade and Industry also reported that the number of fintech startups is growing at an average of 16% yearly. Simply, Filipinos largely use e-wallets and digital banking apps. Through these they send and receive payments, pay bills, donate and use credit.

For the past years, Filipinos were known to be the most active in social media usage compared to the rest of the world. In January 2020, Philippines had a social media penetration rate of approximately 67%. This means that Filipinos spend an average of nine hours and 45 minutes surfing the internet everyday.

What is Online Lending?

Online lending is also called business financing by business owners. Basically, it is financing through online platforms. Before, if you wanted to get a loan, you will need to go to a bank branch, submit documentary requirements, and fill up paperwork. Now, all you need is internet and a mobile phone. From applying to receiving the money, everything is now done online. This digital lending process has become more efficient and streamlined rather than the traditional methods.

It is more efficient because online lending institutions automatically processes the applications. The loan is approved and released within 24 hours. The loan proceedings are then deposited to your bank account or e-wallet. Further, there is a variety of lending options online lending institutions have. Online loans Pilipinas, an online lending institution that offers fast financial solutions to Filipinos.

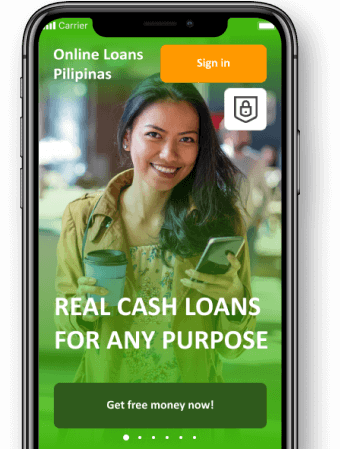

What is Online Loans Pilipinas?

Online Loans Pilipinas or popularly known as OLP is the first instant money loan websites in the Philippines. They are a fintech platform which offers digital financial solutions to the needs of the Filipinos. They mainly focus on online micro and consumer financing to uplift the financial well-being of the customers. Their number one target is to help customers avail a quick loan and get approved for only 4 hours.

They don’t require the complicated documents and paperworks asked by other loan institutions. Just sit at home with your phone and internet connection and borrow up to ₱ 30,000.oo quickly. Online Loans Pilipinas gives a quick and consistent way to deal customers with loan products which enables them to adjust of customers’ changing needs. Mainly to serve you with high business morals and with transparency.

If the questions is Online Loans Pilipinas legit, the answer is yes. Their registration number which is CS201726430, CA No. 1181. However, Online Loans Pilipinas contact number cannot be seen in their website. Read further to see our Online Loans Pilipinas reviews.

The Three Rules of Online Loans Pilipinas

- Fast

The first rule of Online Loans Pilipinas. The company promises to ensure that all necessary things are done in a few minutes during the online application. After you get approved, they also make sure to get your cash immediately through your bank account as well as provide better offers for the loyal customers.

- Convenient

Convenience is one of the main offers of fintech which is also one of the rules of Online Loans Pilipinas. Their application process from filling out to getting your loan. They also make sure to only require a few clicks on your device to complete the whole process.

- Transparent

Trust is one of the pillars of every relationship. Another rule of Online Loans Pilipinas to gain the trust of their clients through being straightforward with the loan details. They make sure that clients are properly informed and educated about their loans’ terms and conditions.

Things to Know About Online Loans Pilipinas Loans

How to Apply for Online Pilipinas Loans?

Applying for to avail for loans in Online Loans Pilipinas is simple and easy. You just need to download their mobile application or go to their website. First time clients are able to loan from ₱1,000 to ₱7,000, and for repeat clients, you can avail for up to ₱30,000 especially if you pay on time. After visiting their website or mobile app, navigate to their online calculator and choose your desired loan amount and loan term. Through the online calculator, your monthly amortization will be displayed.

Then you need to fill all the needed details correctly and accurately especially you mobile number since they will be contacting you through it if you’re approved or they may call you for further verification regarding your details. Approvals for all qualified clients are sent through a text message. Interest rate and fees for first time customers is set at zero while repeat clients’ interest rates are shown on the terms and conditions and disclosure agreement sent to them before the loan is finalized.

For interested clients, they only have a few requirements. One, you need to be 22 to 70 years old with a steady source of income like your employment. Next are your proof of identifications which could either be TIN, Passport, UMID, SSS, PRC or Driver’s license. Lastly, you need to have an e-wallet like Gcash, Paymaya or Grabpay to receive your loan proceeds.

Advantages of Availing Loans Online

Online loans have a quite a number of advantages compared to regular loans offered by banks. One, is they have fewer and easier requirements than a bank loan. You also don’t need collaterals or need any credible credit history as they don’t scrutinize about the borrower’s credit history. Then, they also approve the loans faster which only take about 2-3 business days and some in 24 hours.

Moreso, no deposit bank account is not required as well as a growing credit limit especially when you are a good payer. Their payment scheme is also more flexible as you can choose how long you want to repay you loan. Lastly, it is more convenient since you only need internet connection and your phone.

Disadvantages of Availing Loans Online

Although there are advantages, availing loans online also have several disadvantages. First is the high interest rates compared to the usual personal loans and the loans offered by banks. Clients should be wary of the interest rates and the financial charges which are attached to the loans you are availing. Also, since there are higher interest rates and other charges especially when you avail a longer term for your loan, it might take a toll on your finances rather than help you.

Further, if you pay beyond your due date, a lot of online lenders harass the debtors. Some even resort to posting your personal details online. Although debt shaming could be punishable by law, it often happens to debtors who fails to deposit Online Loans Pilipinas payment on time. According to the National Privacy Commission, they summoned 67 online lending companies including Online Loans Pilipinas due to data privacy complaints.

This may not be the first time Online Loans Pilipinas harassment has been reported. If you search for reviews one of the topics or sentiments of clients include Online Loans Pilipinas complaints. This go from harassment to the delay of posting of their payments, which in return subjects them to harassment.